The Vanguard TOD Plan lets you name individuals trusts or organizations and charities as beneficiaries on your nonretirement accounts. You dont ever have to pay taxes on your capital gains.

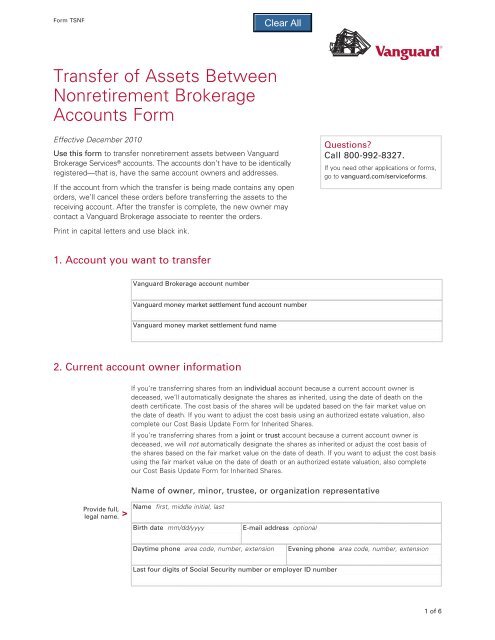

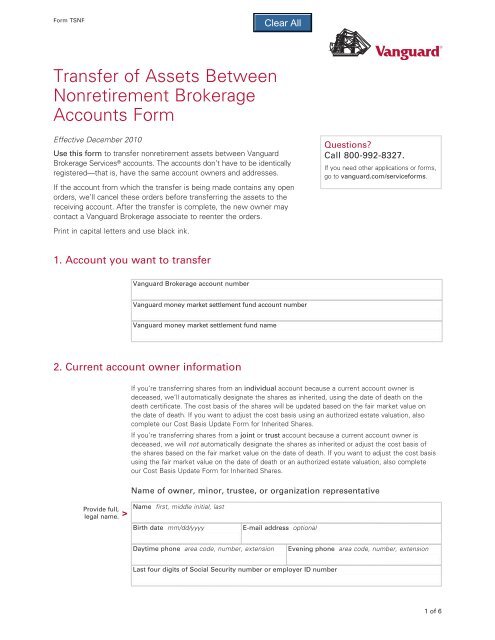

Transfer Of Assets Between Nonretirement Brokerage Accounts Form

Transfer Of Assets Between Nonretirement Brokerage Accounts Form

You can have as many or as few brokerage accounts as you want unless an institution chooses not to allow you to open a brokerage account.

Non retirement brokerage account. Non-Brokerage Account means an account that is exempted from the definition of Account in this Code such as the employees NorthStar 401 k a retirement plan sponsored by a previous employer a Family Members employer sponsored retirement plan accounts held directly at a mutual fund company 529 or other college savings plan and Third Party Managed Accounts. For tax purposes you may need to know how much the investments were worth on the day your loved one diedthe date-of-death value. Call us at 877-445-8798.

That means that you dont have to clear any transactions you make with your beneficiary and you can also. Fill Online Printable Fillable Blank New Fidelity Account Non-Retirement Brokerage Fidelity Investments Form Use Fill to complete blank online FIDELITY INVESTMENTS pdf forms for free. There are no restrictions income investment options limited additions access etc or tax benefits.

Anyone can open or contribute to an UGMA or UTMA but the minor legally owns every contribution characterized as a gift to the account and you cant change beneficiaries for any reason. To fund the account you may choose a lump sum or schedule recurring automatic contributions from a. Any investment account that is not a tax-qualified plan would be considered a non-retirement investment account.

Well send you the information you need and well work with you every step of the way. There is no limit to the number of non-retirement brokerage accounts you are allowed to have. Brokerage account taxable brokerage account and standard brokerage account are different names for a non-retirement investment account.

With non-qualified accounts you can withdraw money at any time although any earnings are subject to capital gains tax. You plan to retire early so you can place your money in a taxable brokerage account and take it out when you need it rather than paying a penalty before age 59 ½. All forms are printable and downloadable.

Essentially a brokerage account is the opposite of a retirement account like an IRA or 401 k in nearly every way. Your beneficiary doesnt have any rights to your brokerage account during your lifetime. If you want to give away stock from a brokerage account you can just directly transfer the shares without selling them which can be beneficial.

You can have multiple brokerage accounts at the same institution segregating assets by investing strategy. A brokerage account is a non-retirement investment account. You want to take on more risk.

Non-Brokerage Account means an account that is exempted from the definition of Account in this Code such as the employees NorthStar 401k a retirement plan sponsored by a previous employer a Family Members employer sponsored retirement plan accounts held directly at a mutual fund company 529 or other college. A brokerage account can be opened at the financial institution of your choosing. Non-qualified accounts allow you to be more strategic about how and when you access your money Retirement accounts have rules around and penalizations for withdrawing money before you reach a specific age generally 59 ½.

Joint accounts pass to the remaining owner when one owner dies The TOD Plan isnt a substitute for a comprehensive estate plan and works best when your instructions are simple and direct. Finally non-retirement investments are usually better for philanthropic activities. Opens a layer layer closed.

Answered 1 year ago Author has 83K answers and 103M answer views A brokerage account is a non-retirement investment account. The data looked at non-retirement investment accounts including things like brokerage accounts non-qualified annuities and both individual and joint investment accounts. What is a non brokerage account.

You can use an UGMA or UTMA to save for any goal other than parental obligations such as. Once completed you can sign your fillable form or send for signing.