According to the numbers from The International Tables of Glycemic Index and based on the mean of five studies the glycemic index of carrots is about 39. Non-starchy vegetables are usually not tested for GI value as they do not have a great deal of carbohydrate content so they tend to have close to zero GI valuesThey cause very little or no spike in blood glucose levels.

What Is The Glycemic Index Gi And Glycemic Load

What Is The Glycemic Index Gi And Glycemic Load

Whole grains are often lower-GI than refined whole fruit is lower-GI than fruit juice and raw carrots are lower-GI than cooked.

Carrots glycemic index. Should still be included in. Beans string green cooked from canned. Low Glycemic Index 55 or less Choose Most Often Medium Glycemic Index 56 to 69 Choose Less Often High Glycemic Index 70 or more Choose Least Often Apple Apricot Fresh Dried Banana Green Unripe Berries Cantaloupe Grapefruit Honeydew Melon Mango Orange Peach Pear Plum Pomegranate Prunes Additional foods.

The main concern with the vegetable is its impact on blood sugar levels. Pure sugar has a glycemic index of 100. The glycemic response of carrot juice was lowered to 66 by consuming oil along with the juice.

The Glycemic index of carrots is assessed by the Glycemic Index Institute and they have a GI of 41 which is a moderate level. Vegetables and Glycemic Index. Watermelon The GI of watermelon is 72 putting it in the high category.

For instance a food with a glycemic index of 30 doesnt raise the blood glucose that much at all but GI doesnt consider how big the serving size is or how much you eat. Carrots are a low-GI food with a glycemic index of between 16 and 49 depending on how they are prepared. Foods that are low in carbs and low on the glycemic index tend not to.

I still eat them though just in moderation. The Glycemic Index GI chart shows how much and how quickly a carbohydrate-containing food raises your blood-sugar levels. Three large sugary whole sliced or grated carrots have a volume of about 3 cups.

If you are aiming to lower your dietary GI you can include an abundance of vegetables such as carrots eggplants tomatoes onions mushrooms broccoli cauliflower lettuce green beans bell peppers summer squash and cabbage. Banana Ripe Yellow Cherries Bottled. Beans string green cooked from canned fat added in cooking.

According to Harvard Medical School carrots have a glycemic index ranking of 47 plus or minus 16. I still eat them though just in moderation. A medium carrot contains only 4 grams of net digestible carbs and is a low-glycemic food.

The standardized Glycemic Index ranges from 0 to 100. Zero-glycemic foodsthose without carbohydratesinclude items like meats fish and oils. Carrots My favorite vegetable the carrot makes an appearance on the GI index at 71.

Since 1 medium sized carrot contains 106 grams of carbohydrates and makes the glycemic load of 75 it is safe for diabetics to consume carrots. The Glycemic Index chart below uses a scale of 1 to 100 for Glycemic Index and 1 to 50 for Glycemic Load values glucose having the highest GI value of 100 and GL of 50. Is carrot safe for Diabetics.

The effect of carrot juice on blood sugar was tested. Raw carrots have a GI of 16 dicing those increases the GI to 35 and boiled carrots have further increased GI of 49. The glycemic index of carrot is 71 which makes it high GI vegetable.

But when I ask them what they eat for breakfast lunch dinner and snacks and what they drink I can see that they dont understand the concepts of the glycemic index. Beans string cooked from canned. Through this study we measured the glycemic index of carrot juice to be 86 on a scale where the glycemic index of bread is 100.

The glycemic index of carrot is 71 and the glycemic load is 75. Glycemic Index versus Glycemic Load. Unduh Full Movie Glycemic Index Of Carrots Bluray.

There are many factors that go into determining the glycemic index ranking of a food including how much the food is cooked and how much the food is processed. Starchy vegetables can have medium to high glycemic index but the high GI vegetables- potatoes corn beets etc. Most diabetes patients tend to avoid eating carrots because of the sweetness.

Sebagai movie extended versions Glycemic Index Of Carrots terbaru MKV bisa teman-teman download free dan nonton dengan ketajaman terbaik. Raw carrots have the lowest glycemic index ie. 16 which makes it a perfect fit for diabetes.

Most vegetables have a low GI with only a few exceptions. It is higher in fiber protein andor fat and lower in sugar and refined starch. Jangan sampai ketinggalan unduh dari Rezmovie dengan server unduh mediafire.

The sugar content and glycemic load of carrots is equal to. The lower a food is on the GI the lower the effect on your blood sugar. Carrot juice is an integral part ofThe Hallelujah Dietsm.

Farm fresh carrots are sweet when eaten raw and even sweeter when roasted. The glycemic index of.

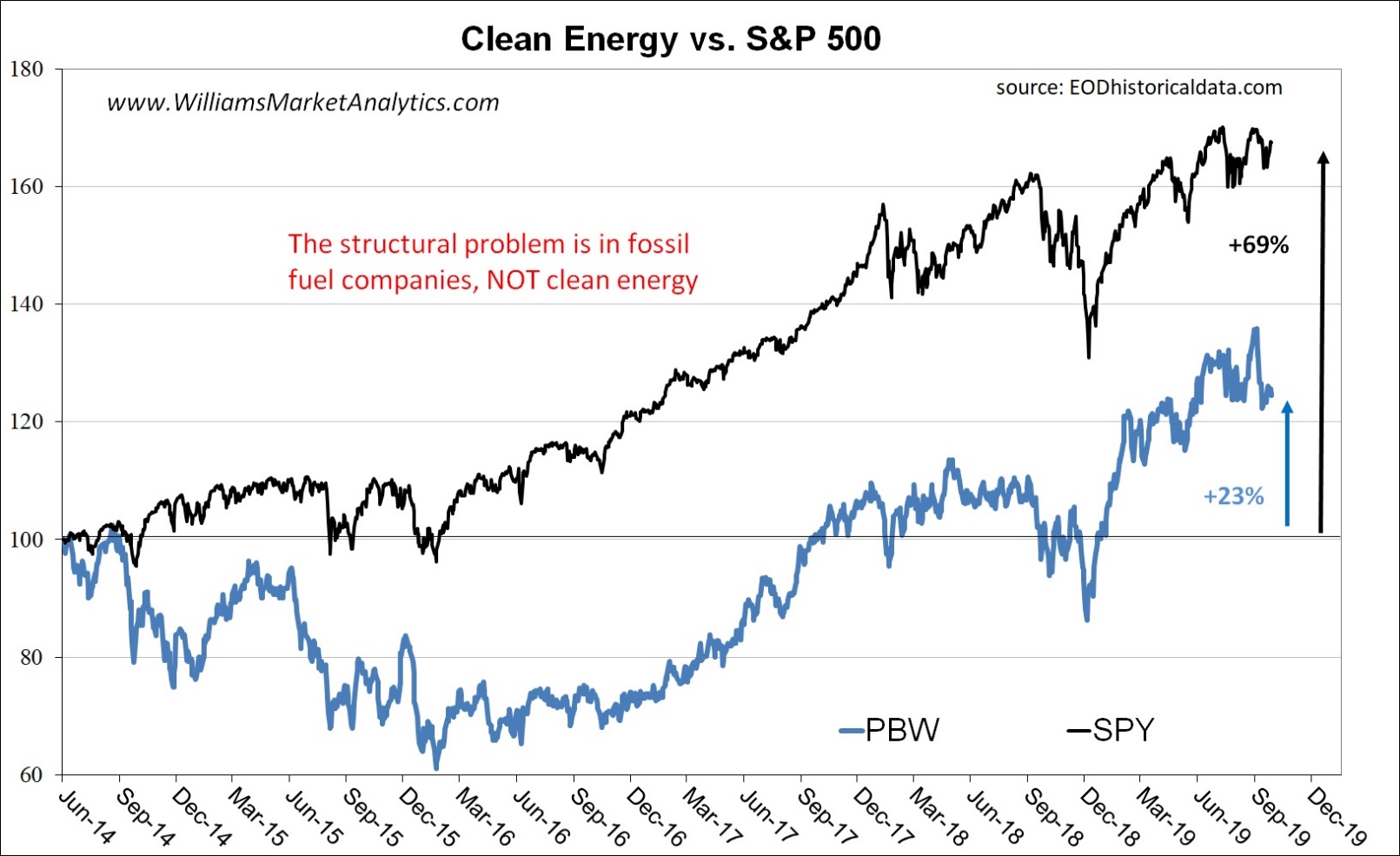

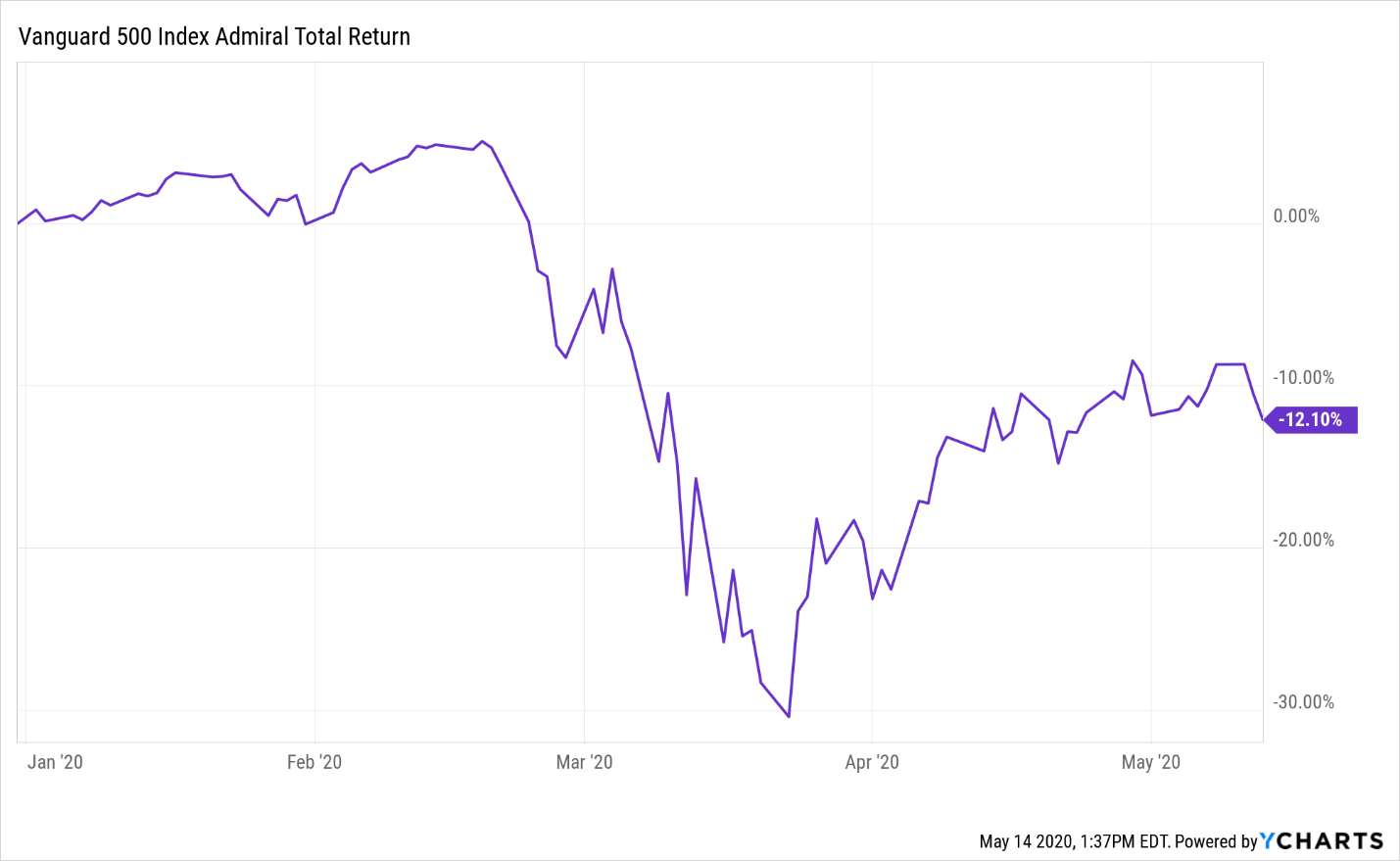

5 Best Index Funds For 2021 Returns Expenses More Benzinga

5 Best Index Funds For 2021 Returns Expenses More Benzinga