Passive income is defined as income that requires minimal effortor perhaps even zero effortto earn. A monthly dividend portfolio is one option to add to your multiple streams of income strategy and put you on the path to early retirement.

Building A Dividend Growth Portfolio For Passive Income

Building A Dividend Growth Portfolio For Passive Income

That means that instead of 408500 you would need just over 167 million to secure an annual income of 50000 a year in dividends and franking.

Dividend passive income. Dividends fall into the investment category. Shaq is a perfect example of classic passive income. Setting up monthly dividend income is going to.

Passive income can mean early retirement and financial freedom. You reap the benefits of dividend income after putting in some upfront time to make your investment decision. I will discuss three of the most trustworthy dividend stocks that passive income-seeking investors prefer as staples in their portfolios.

Investors own a small part of these public companies and they work for you. As with active income passive income is usually. CFR The list starts with a financial holding company.

10 - CullenFrost Bankers Inc. Creating a passive income with dividend investing. In addition you are a minority owner in a business and maintain no controlling-interest decision making.

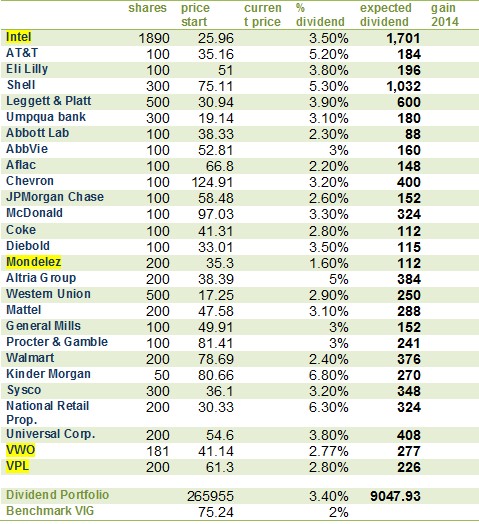

These days I focus on companies that consistently grow their dividend income over the years. But there is another type of passive income that requires very low setup costs and which anyone can start. We can compare it against active income where your effort is.

Passive income is earnings derived from a rental property limited partnership or other enterprise in which a person is not actively involved. Passive income typically enables your money to work for you. There is no debate about it in my opinion.

You reap the benefits of dividend income after putting in some upfront time to make your investment decision. Balance is the key for dividends. Passive income qualifies for capital gains tax which is a lower rate than ordinary income tax making it more attractive.

Its a work smarter not harder situation. A FTSE 100 share for passive income. Most types of passive income require either 1 money to invest or 2 time and effort up front in order to set up the passive income stream.

Like many other creative professionals I dream of being able to to commit 100 to an exciting new project without having to necessarily worry about its profitability here and now. There is no debate about it in my opinion. Creating a dividend portfolio that can pay you this much might be challenging but it.

We are talking about passive income from stock dividends one of the best options for passive income available to. Dividend income is my favorite form of passive income. Having said that now lets have a closer look to 10 best dividend stocks for passive income.

2021 target 17000 passive income. Dividends are purely passive income. What is Passive Dividend Income.

To achieve this dream I need some kind of passive income. With double-digit dividend growth 19 consecutive years of dividend raises and the potential that shares are 11 undervalued this dividend growth stock is perfect for investors who have time to let it magically compound their wealth and passive income. And if you do it right youll provide an ongoing stream of income for your future.

With dividend stocks you can leave your principal investment alone. - September 7 2011December 31 2014 - Sustainable PF This is a staff post from LaTisha who writes about investing for beginners saving and money management for the young adult or recent grad at Financial Success for Young Adults. Passive income is a beautiful thing especially when it pays you additional money each month.

After all youre building this portfolio to stand the test of time. 1000 per month is more than a decent amount to generate through passive income. If you want to be able to break free from the requirement to work for a living you should be focused on creating streams of passive income.

Legal General which has just gone ex-dividend this week is one of the biggest dividend payers on the FTSE 100It has a dividend. Dividends are purely passive income. However dividends do not fall under the passive income category as.