As of 2019 this limit is 17640 per year or 1470 a month. For security the Quick Calculator does not access your earnings record.

How To Estimate How Much Social Security You Ll Get Each Month Dummies

How To Estimate How Much Social Security You Ll Get Each Month Dummies

So benefit estimates made by the Quick Calculator are rough.

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

How much social security can i draw. You can use the Retirement Estimator if you have enough Social Security credits to qualify for benefits and you are not. Your Social Security benefits would be reduced by 5000 1 for every 2 you earned over the limit. The total depends on your benefit amount and the number of family members who also qualify on your record.

The average Social Security benefit was 1543 per month in January 2021. You should apply four months before you want your benefits to start. If the parent is deceased the child is eligible to receive up to 75 of.

Your annual income from Social Security will be reduced to 5320 from the total 14000 because 8680 of your benefits will be withheld. For 2021 that limit is 18960. Instead it will estimate your earnings based on information you provide.

The maximum Social Security reduction will never be greater than one half of your pension amount. A child may receive a Social Security benefit equal to 50 of the parents full retirement benefit or disability benefit. You are entitled to 800 per month in benefits.

This is capped at a monthly reduction of 498 maximum WEP reduction for 2021. You would receive 4600 of your 9600 in benefits for the year. If you are under full retirement age for the entire year we deduct 1 from your benefit payments for every 2 you earn above the annual limit.

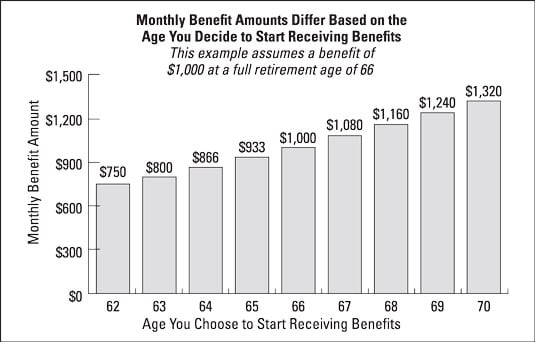

Social Security will pay the higher of the two amounts. However there is a limit to the amount we can pay your family. If you start benefits between the month you turn 62 and the month you reach full retirement age the Social Security Administration will deduct one dollar from your annual benefit amount for every two dollars you make above an annual limit.

Waiting for a decision about your application for benefits or Medicare. In general a divorced spouse is entitled to a Social Security benefit thats equivalent to 50 of the ex-spouses retirement benefit even if the ex-spouse has remarried. Age 62 or older and receiving benefits on another Social Security.

You can apply for Social Security retirement benefits when you are at least 61 years and 9 months of age. This is the amount that is. If you have a work history you may be eligible for a personal benefit.

You will not receive a survivor benefit in addition to your own retirement benefit. The maximum possible Social Security benefit for someone who retires at. Weve said if you file at 62 youll get 75 of your FRA benefit amount and if you wait until 70 youll get 132 of your benefit amount.

If you have more than 20 years of substantial covered earnings where you paid Social Security tax the impact of the WEP begins to diminish. Currently receiving benefits on your own Social Security record. For the year in which you will reach FRA the earnings limit is different.

If you file a 2020 individual return and your combined income is greater than 34000 as much as 85 percent of your benefits are taxable. Benefit estimates depend on your date of birth and on your earnings history. During the year you reach FRA and up to the month you reach FRA Social Security will deduct 1 for every 3 you earn that is over the annual earnings limit.

If you are eligible. Suppose you reach full retirement age this year. If the spouse is deceased.

If you apply on the basis of caring for a child who is under 16 or disabled you can collect 75 percent of the late spouses benefit regardless of your age. According to the Social Security Administration website each family member may be eligible for a monthly benefit of up to 50 percent of your disability benefit amount. We use the following earnings limits to reduce your benefits.

The Social Security Administration only includes the portion of a workers income up to the maximum taxable earnings limit. 9600 - 5000 4600 Reach full retirement age in August 2021. In that case the earnings limit is 50250 with 1 in benefits withheld for every 3 earned over the limit.

If you work and earn 80000 you have exceeded the. For years weve used nice round numbers when calculating the impact of filing for social security benefits early or later. If you have a part-time job that pays 25000 a year 6040 over the limit Social Security will deduct 3020 in benefits.

In this situation you can receive your own personal benefit if it is greater than the spousal benefit. According to the 2020 IRS rules. In 2020 the earnings limit is 48600 which means that you can earn up to 46600 before having any pay deducted.

If you file an individual return and have a combined income of 25000 to 34000 50 percent of your Social Security benefits may be taxed. Even if you are not ready to retire you still should sign up for Medicare three months before your 65th birthday. In the year you reach full retirement age we deduct 1 in benefits for every 3 you earn above a different.

9600 for the year.