2 to 10 year treasury yield spread United States Treasury securities are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. A 10-year Treasury note is a bond issued by the government that matures within a decade.

Treasury securities are often referred to simply as Treasurys.

What is the 10 year treasury. They must compensate investors for their higher risk of default and account for any loan processing fees. The 10 year treasury yield is included on the longer end of the yield curve. In the US these loans take the form of Treasuries including the 10-year Treasury note which play an essential if often overlooked role in the basic function of government and the economy.

Mortgages and other loan rates will always be higher than Treasurys. What Is a 10-Year Treasury Note. 10-Year Treasury yields weekly chart 2 5 21.

Investors who want a safe-haven assetsomething thats dependable in times of uncertainty because it still earns a return. A 10-year Treasury note. The 10-year is used as a.

The 10 year treasury is the benchmark used to decide mortgage rates across the US. Heres what one hedge fund trader says happened in Thursdays bond-market tantrum which sent the 10-year Treasury yield to 160. To learn more about 10-year Treasury notes and whether or not you should include them in your investment strategies continue reading.

The importance of the 10-year Treasury bond yield goes beyond just understanding the return on investment for the security. In the world of bonds returns are known as yields. The 10-year Treasury yield responded by falling as low as 1536 on Thursday its lowest trading level since March 12a sign perhaps that the bond market is concerned about the future path of.

And is the most liquid and widely traded bond in the world. The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year.

Rates rose 93 basis. 10 Year Treasury US10YUS real-time stock quotes news price and financial information from CNBC. The 10-year Treasury note yield indicates the confidence that investors have in economic growth.

The 10-year Treasury note BXTMUBMUSD10Y was yielding 1571 up 4 basis points based on a 3 pm. Alas todays hottest bond is the 10-year Treasury note which the government issues to borrow money the 10 means it matures in 10 years So who buys the 10-year. The 10-year Treasury note is a safe investment that pays interest and principal to investors and is backed by the US.

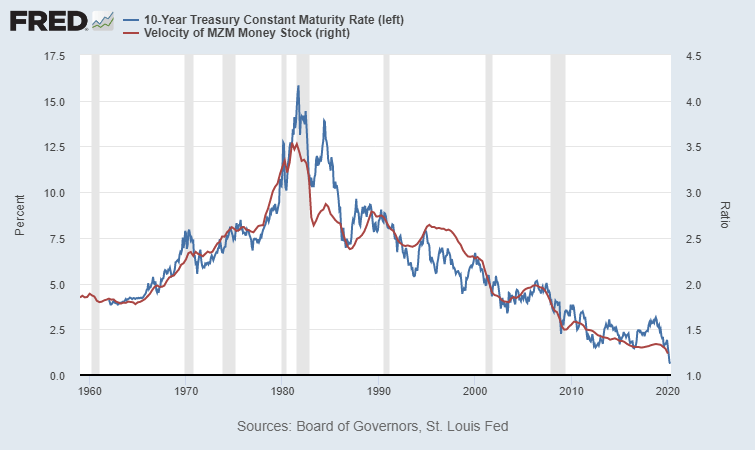

Yields run higher during inflationary periods or times of investor panic. The current 10 year treasury yield as of. Many analysts will use the 10 year yield as the risk free rate when valuing the markets or an individual security.

Movements in the notes yield tend to reflect movements in 30-year mortgages. These bonds are issued in 1000 increments with a. For one thing its clear that the long-term downtrend in yields has ended.

ET by Sunny Oh. 26 2021 at 455 pm.