Most taxpayers receive their refunds within 21 days. The IRS says it issues most tax refunds within 21 days but many people typically get their refunds much sooner.

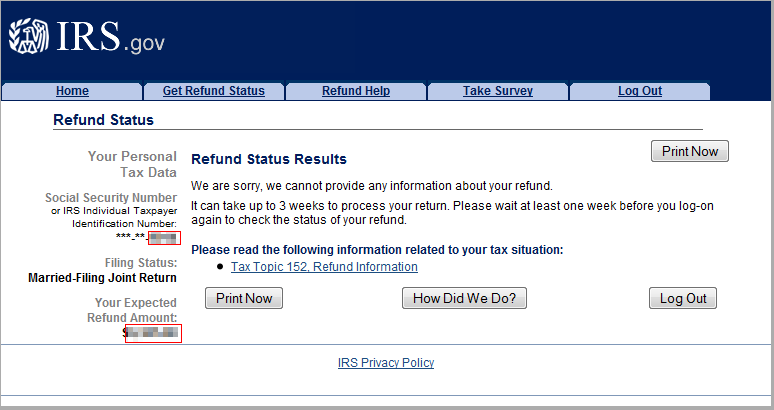

We Cannot Provide Any Information About Your Refund Refundtalk Com

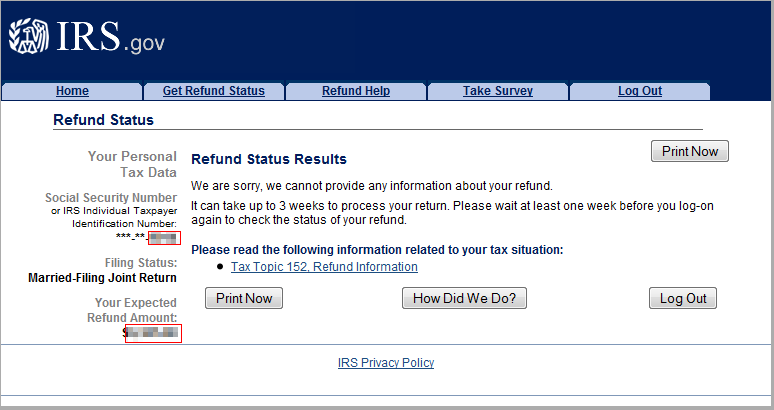

We Cannot Provide Any Information About Your Refund Refundtalk Com

How long it might take to get your tax refund The IRS says it issues most tax refunds within 21 days but many people get their refunds much sooner.

Irs refund s. IRS Commissioner Charles Rettig on Thursday said the millions of Americans whose tax returns have been caught in a processing backlog created by the pandemic which shut down the IRS for a time should see their refunds in the coming months. Once most of the tax returns are completed the. Once most of the tax returns are completed the.

However this year the IRS is reportedly. The IRS for instance can adjust returns for taxpayers who claimed the Earned Income Tax Credit a refundable tax credit for low- to moderate-income working individuals and couples particularly. Reason for Tax Refund Delay.

That may require further identity verification and delay your tax refund. According to the law the IRS has to wait until Feb. You Claim Certain Credits.

Additional weeks of a. The IRS issues more than nine out of 10 refunds in less than 21 days according to the agency. A tax return is a form you file each year with the IRS that details your adjusted gross income AGI expenses and other financial information.

Check Your Federal Tax Refund Status If you have filed your federal income taxes and expect to receive a refund you can track its status. Most of these details comes from your W-2 statement. If you file on the early side and claim the earned income tax credit EITC or the additional child tax credit ACTC you will have to wait a bit for a refund.

If you choose to have your refund deposited directly into your account you may have to wait five days before you can gain access to it. Thats nearly three times the number in the same. IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

Tied into tax refunds the IRS is also sending out missing stimulus money from the first two checks. Have your Social Security number filing status and the exact whole dollar amount of your refund ready. Here are some possible dates The IRS says it issues most tax refunds within 21 days but many people typically get their refunds much sooner.

However this year the IRS is. The IRS will start issuing tax refunds in May to Americans who filed their returns without claiming a new break on unemployment benefits the federal. 1040 and Schedules 1-3 Individual Tax Return Other 1040 Schedules Information About the Other Schedules Filed With Form 1040 Form 4868 Application for Automatic Extension of Time to File.

However this year the IRS is. For those who received unemployment benefits in 2020 a 10200 tax exemption was added to the details of the American Rescue Plan. Sometimes a return may take longer to process if.

You can also check the status of your one-time coronavirus stimulus check. Roughly 76 million returns havent been processed yet so far this tax season according to IRS filing statistics through the week ended March 12. If you accidentally enter the wrong SSN it could trigger an IRS Error Code 9001.

Tied into tax refunds the IRS is also sending out missing stimulus money from the first two checks. 15 to issue a refund to taxpayers who claimed either of those credits.