But if youre investing through a taxable account these dividend payments will lead to. But there are.

10 Best Dividend Stocks To Buy In 2021

10 Best Dividend Stocks To Buy In 2021

If youre investing through a tax-deferred account dividends wont impact your tax situation.

How to buy dividends. Thus buying a stock before a dividend is paid and selling after it is received is a pointless exercise. The Dividend Aristocrats Index which is maintained by SP Indices is a great place to start. You buy stocks that pay reliable dividends so you can generate regular income from your investments.

In the dividend yield box set the leftmost value to 2 and the rightmost box to 100. Find me on Etoro. Thats when you put compound growth on autopilot.

If we assume the share price will return to about 4 not going to expect it to return to its pre-pandemic high and that the dividend yield remains the same at 44 they will pay a dividend of 176. Interested in how dividends work. Choosing and purchasing which dividend stock to buy.

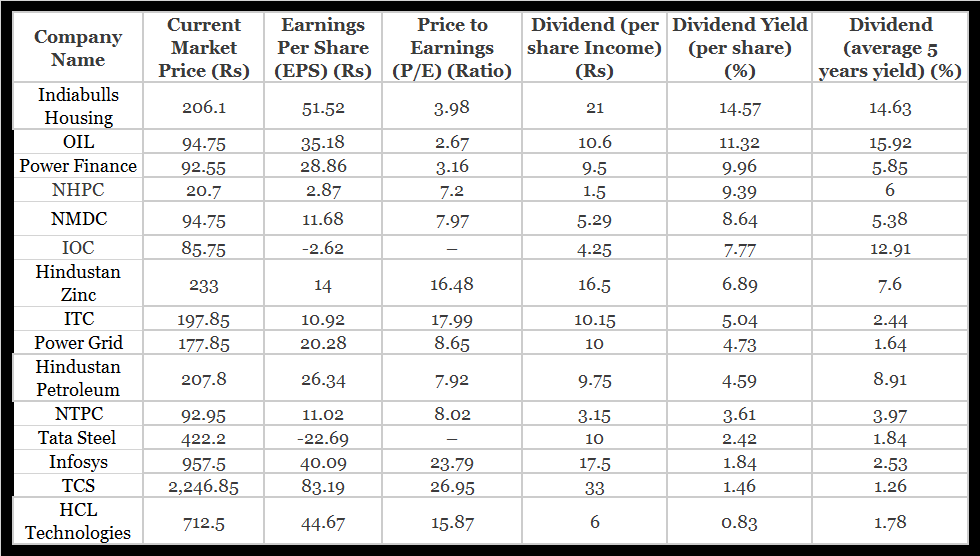

Trying to time the purchase of dividend stocks or dividend mutual funds can be risky and may not be beneficial to investors. The reason is that you should focus on reaching a certain number of shares to DRIP at least one share. Dividend yield Dividend per share price per share For example if a company gives an annual dividend of Rs 10 and its current market price is Rs 200 the dividend yield of the company will be 10200 5.

Take the example of ST Engineering with a reported dividend yield of 44. How to Buy Dividend-Paying Stocks. If we buy 10 lots at a current price of 310 we will spend 3100.

Investing in a dividend mutual fund or ETF can help you diversify your portfolio by spreading your investment across a number of different stocks. Buying dividend stocks is a strategy that can also be appealing to investors looking for lower-risk investments. The dividend yield shows you how much dividends youll get if you buy a certain amount of the companys stock.

Investors who buy and hold dividend paying stocks and dividend mutual funds are wise to understand how dividends work. The dividend yield a stock offers at the time of purchase. It could seem like a good idea to buy shares of a stock or fund just in time to get the dividend paymentbut in many cases its not.

This will look for all stocks which pay dividends worth between 2 and 100 of the current stock price. Stocks that pay dividends can be some of the least volatile to own. You hope they appreciate in value but whether the value goes up or down youre still collecting money either way.

What if every month a different stock matches your criteria there is a point where you need to stop adding new stocks to your portfolio. Why Dont Investors Buy Stock Just Before the Dividend Date And Sell Right Afterwards. Dividend yield Get this ratio by dividing the companys annual dividend by its stock price.

This is a collection of several companies that have increased their. For example if a stock has a 4 dividend yield and you have bought RM10000 worth of shares youll get RM400 in dividends. The health of the companys balance sheet because investing in companies with tons of debt and declining sales presents a real risk no matter how large the dividend may appear.

Through mutual funds such as index-funds or exchange-traded funds that hold dividend stocks or. Dividend investing is a strategy. Dividend yield is the ratio of annual dividend per share divided by the price per share.

We give you a full explanation on how to understand stock dividends. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend then selling it immediately after the dividend is paid. Even just knowing the basics can give you much higher returns than investing in real estate or buying stocks merely for growth.

The formula for dividend yield is given below. But buying individual shares is not the only route to take. There are two main ways to invest in dividend stocks.

Investing in dividend-paying stocks can forever change your financial situation for the better. Step 3 Choosing the Dividend Stock to Buy. This includes the dividend dates which define when and if shareholders qualify to receive the dividend.

Dividends are announced several days or weeks before theyre paid. Httpsetorotw2rcYYm0How do we get these dividends on Etoro - this is the second video in my short series about dividends a subject Iv. The rate of growth in the companys profit which can be used to project future dividend increases.

The current dividend tax laws such as the net investment. Under Valuation select PE Ratio and under Dividend select Div yield These little selector boxes let you set minimum and maximum values. You can buy individual shares of dividend-paying stocks the same way you buy any stock using your brokerage account.

Five Dividend Aristocrats to buy. They can also help you.