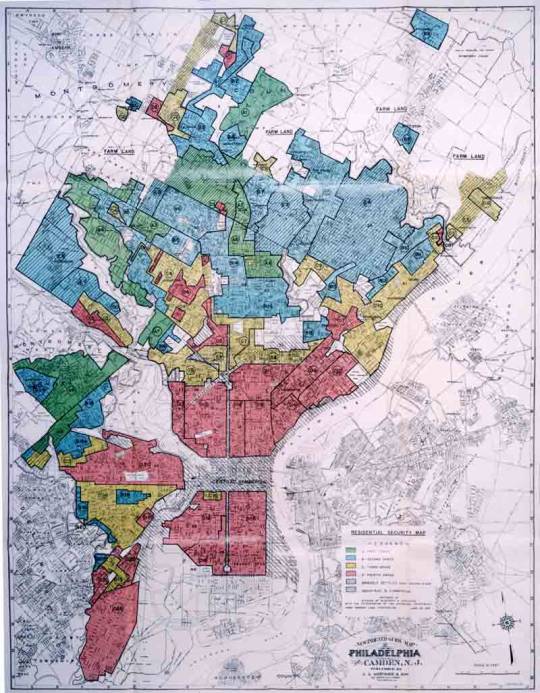

Redlining is the discriminatory practice of denying services typically financial to residents of certain areas based on their race or ethnicity. In the real estate and finance industry redlining refers to the practice of financial institutions defining specific neighborhoods or areas on a map as less desirable to lend to.

A Short History Of Redlining Smart Cities Dive

A Short History Of Redlining Smart Cities Dive

What is redlining reverse redlining.

Redlining real estate. Redlining discrimination primarily focuses on minority communities and has been illegal for over 50 years. Redlining describes a practice by some mortgage lenders when they refuse to lend money or extend credit to borrowers in certain areas of town or for other discriminatory reasons. What Is Redlining in Real Estate.

People of color are still likely to be denied a. It can also apply when real estate agents follow similar practices in showing homes. Redlining is a term used to refer to a now-illegal practice in the mortgage lending industry.

Redlining was outlawed in 1968 when the Fair Housing Act was passed but it still happens today with home loans and appraisals said Baker. Redlining and American racism have a long and nuanced background and this article is just a basic overview of the policys history and how it continues to affect real estate and nonwhite. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didnt want to make loans.

And those maps were color-coded by. 1031 Exchange 1031 tax deferred exchange. Redlining is a type of lending discrimination.

The term redlining. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky.

The profiteering real-estate practice of buying homes from white majority homeowners below market value based on the implied threat of future devaluation during minority integration of previously segregated neighborhoods. The illegal practice of denying loans or restricting their number for certain areas of a community. More Real Estate Definitons.

Redlining in real estate is often used to describe discrimination in mortgage lending based on demographics. Redlining the practice of banks and real estate agents steering black and Latino families away from predominantly white neighborhoods is often spoken of in the past tense. Comes from the development by the New Deal by the federal government of maps of every metropolitan area in the country.

What is redlining. The term redlining is a nod to how lenders identified and referenced neighborhoods with a greater share of people deemed more likely to default on mortgage. Redlining is the practice of denying credit to particular neighborhoods on a discriminatory basis.

Redlining was a practice first used by banks decades ago that directly targeted Black and brown homebuyers by denying insurance loans and other. Redlining the practice of discriminatory lending in home mortgages used to be the norm. Even if a credit-worthy applicant applied to buy a home in those neighborhoods they could be denied.

In this lesson youll learn about redlining. Redlining is when a government agency or a private company denies a particular group of people services either directly or by placing strict criteria that disadvantage them. It is a practice where mortgage companies deny or offer less favorable.

Real estate buyers sellers renters and professionals must be cognizant of certain unethical and illegal practices involving real estate transactions. A look at the Federal Housing Administration Underwriting Manual of 1938 shows that segregated housing by ethnicity was considered a desirable stabilizing force. As a result financial institutions would refuse to lend to people who wanted to purchase homes in these areas.

Although the practice was formally outlawed in 1968 with the passage of the Fair Housing Act it continues in various forms.