Another option is the Guggenheim Dow Jones Industrial Average Dividend ETF DJD. Index funds and ETFs This is the easiest and the most suitable way for long-term Dow Jones Investments.

Dow Jones Industrial Average Wikipedia

Another variation on the concept is the ProShares UltraPro Dow30 which buys stocks to triple the return of the Dow.

Best dow jones index fund. Alternatively you can invest in a Dow index fund. Indexes like the SP 500 or the Dow Jones Industrial Average in the United States offer a barometer of overall stock market performance. The funds goal is to track the total return of the entire US.

If you want to own an investment that tracks the Dow Jones Industrial Average you can do it by buying shares in. The table below includes fund flow data for all US. The ProShares Ultra Dow30 NYSEARCA.

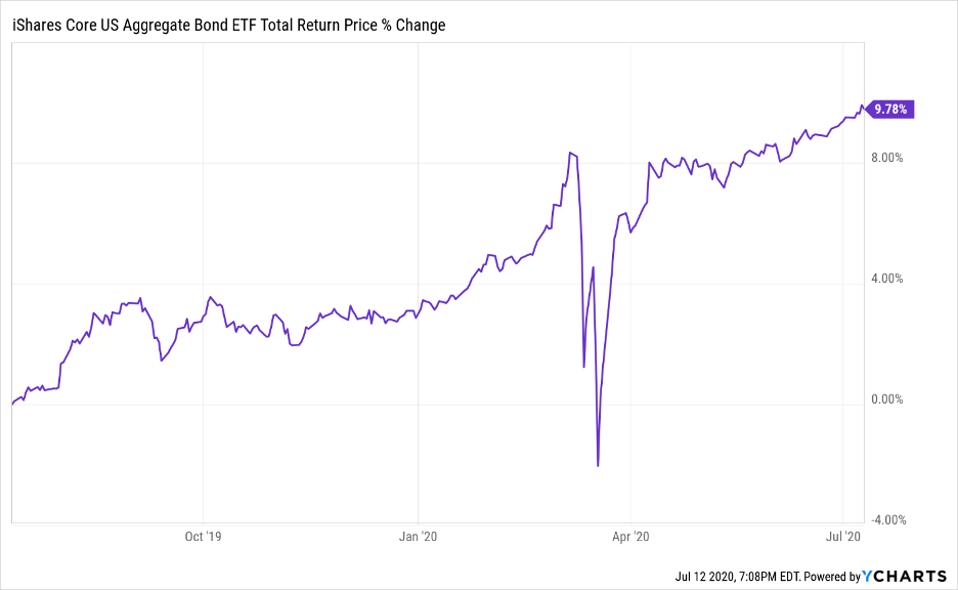

Index funds are usually publicly traded mutual funds that hold a portfolio exactly the same as a specified market index Dow Jones Industrial Average for example. However like most stock indices the Dow has suffered heavy losses as a result of the coronavirus pandemic but historically it has been a sensible investment option. Should I invest in the Dow Jones.

Unlike the price-weighted tracking that the Dow is known. The Dow is an index of 30 of the largest and most successful companies on US stock exchanges. The funds goal is to match the total return of the Schwab 1000 Index.

Between 2009 and 2019 the Dow gained over 21000 points an increase of around 260. SPDR Dow Jones Industrial Average ETF DIA The SPDR Dow Jones Industrial Average ETF is a reliable ETF for replicating the performance of the Dow. Ad Buy On Blue Sell On Red Signals SC Trading System Awards since 1997.

Listed Highland Capital Management ETFs. That can be useful if youre particularly optimistic about the indexs performance. Snap Inc Class A.

Large-Cap Growth Index Fund. The investment seeks to provide investment results that match before fees and expenses the performance of the Dow Jones Industrial Average on a daily basis. Schwab 1000 Index Fund.

Stock market as measured by The Dow Jones US. Here are several ETFs that track the Dow. SPDR Dow Jones Industrial Average ETF DIA iShares Dow Jones.

One of the benefits of buying an index fund is that it typically has low expenses. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Total Stock Market Index.

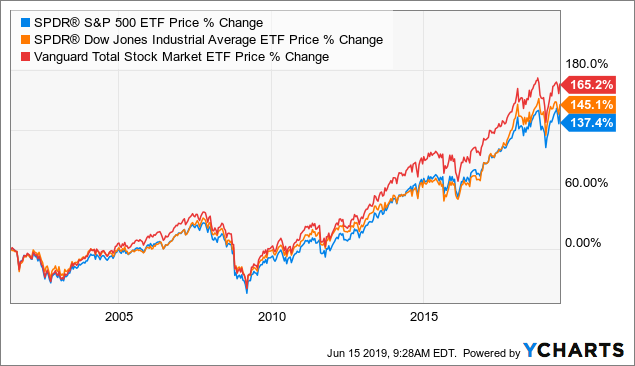

The SP 500 is. The Dow Jones Industrial Average is a price-weighted index comprised of 30 blue-chip stocks. The Dow has dramatically underperformed the SP 500 over the past year.

DDM reflects two times the daily performance of the Dow Jones. If we extend the period the SP 500 has outperformed the Dow Jones over a five year and 10-year period by 17 percent and 367 percent respectively. Zoom Video Communications Inc.

ETFs Tracking The Dow Jones Industrial Average ETF Fund Flow. Ad Buy On Blue Sell On Red Signals SC Trading System Awards since 1997. Some popular ones are the SPDR Dow Jones Industrial Average ETF and the ProShares Ultra Dow30.

It achieves this by owning the overall stocks as well as.

5 Best Index Funds For 2021 Returns Expenses More Benzinga

5 Best Index Funds For 2021 Returns Expenses More Benzinga

5 Best Index Funds For 2021 Returns Expenses More Benzinga

5 Best Index Funds For 2021 Returns Expenses More Benzinga

And The Winner Is The Djia Seeking Alpha

And The Winner Is The Djia Seeking Alpha

Chart Implementation 916x580 Investing Dow Jones Index Global Fund

Chart Implementation 916x580 Investing Dow Jones Index Global Fund

5 Best Index Funds In April 2021 Bankrate

5 Best Index Funds In April 2021 Bankrate

Here Are The Best Ways To Buy The Dow Jones Index Investorplace

Here Are The Best Ways To Buy The Dow Jones Index Investorplace

The 3 Best Dow Jones Stocks So Far In 2020 The Motley Fool

The 3 Best Dow Jones Stocks So Far In 2020 The Motley Fool

Vanguard Total Etf Stock Ishares Dow Jones Us Index Fund Etf Hasan Hd Salon

Vanguard Total Etf Stock Ishares Dow Jones Us Index Fund Etf Hasan Hd Salon

3 Etfs That Track The Dow Jones Industrial Average Etf Trends

3 Etfs That Track The Dow Jones Industrial Average Etf Trends

5 Best Index Funds For 2021 Returns Expenses More Benzinga

5 Best Index Funds For 2021 Returns Expenses More Benzinga

Vanguard Total Stock Market Index Hits The Trillion Dollar Milestone Morningstar

Vanguard Total Stock Market Index Hits The Trillion Dollar Milestone Morningstar

5 Best Index Funds For 2021 Returns Expenses More Benzinga

5 Best Index Funds For 2021 Returns Expenses More Benzinga

Best Index Funds For 2016 The Motley Fool

Best Index Funds For 2016 The Motley Fool

/GettyImages-1060422076-478eeaa2708a440da441aed90db754a7.jpg) The 4 Best Total Market Index Funds

The 4 Best Total Market Index Funds

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.