Walmart NYSEWMT Clorox NYSECLX ATT NYSET McDonalds NYSEMCD Realty Income NYSEO. The Zacks Consensus Estimate for its current-year earnings has risen 11 over the past 60.

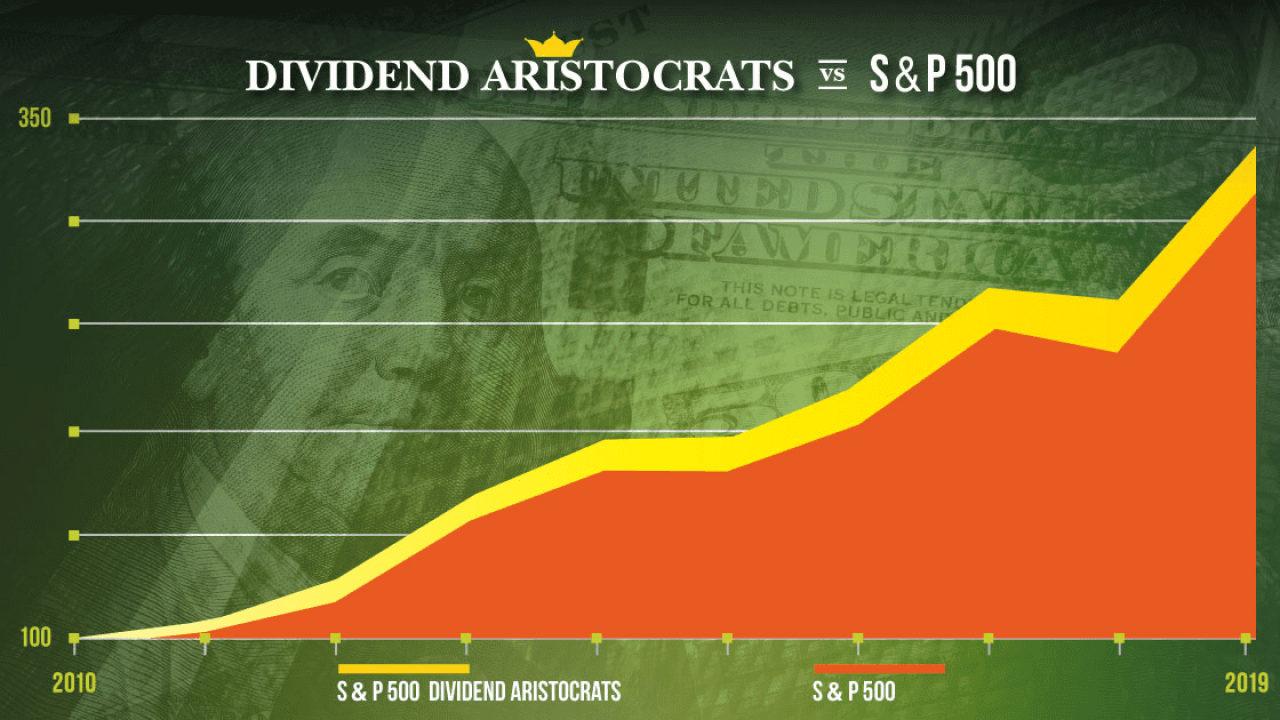

9 Dividend Aristocrats To Buy Now Stock Market News Us News

9 Dividend Aristocrats To Buy Now Stock Market News Us News

Three dividend aristocrat stocks to buy All told Hormel offers a rock solid balance sheet a useful 2 dividend yield and relatively defensive end market exposure.

Best dividend aristocrats to buy now. Finally Aflac is one of the most stable stocks to buy now among dividend aristocrats. At 26x forward earnings ABT trades at a notable premium to Medtronic NYSE. This article walks you through how I screen for dividend growth.

In order of most to least undervalued the 10 best aristocratschampions to buy today are. Whatever the case Aflac and by logical deduction AFL stock has opportunities to rise through word of mouthFinally Aflac is one of the most stable stocks to buy now among dividend aristocrats. The price-earnings multiple has steadily expanded in recent years.

Best Dividend Aristocrats. The company has raised its dividend for 33 consecutive years. Abbott Labs ABT Source.

Reasons why Johnson Johnson could be a good choice to start your investment portfolio. Admittedly ABT is one of the dividend aristocrats with valuation concerns. Ad Transparent independent and extensively researched investment analyses.

Ad Transparent independent and extensively researched investment analyses. 7 Growth Stocks You Dont Want to Sleep On Lets look at seven dividend stocks to own now. The 4 Best Dividend Aristocrats to Buy Now.

InvestorPlace - Stock Market News Stock Advice Trading Tips. Here well focus on the five best Dividend Aristocrats listed on the TSX that you can buy now to start a growing income stream. With 62 consecutive years of dividend growth 3M is a shining example of a slow-and-steady dividend aristocrat that is committed to driving shareholder value through sharing its profits directly.

MDT another health care dividend aristocrat. The company currently has a Zacks Rank 1. PII MDP CAT GD GWW and MO represent the six best dividend aristocratkingschampions you can buy for 2020 and well beyond.

Reasons why Johnson Johnson could be a good choice to start your investment portfolio. Over the last 20 years its total annual dividend payouts per share have risen from 083 to 439 up more than five-fold and increasing at a rate of 9 per year on average. 24 2020 0647 PM.