State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year. If youre stressing about how unemployment benefits affect your taxesdo you pay do you not pay.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Some states always provide tax-free unemployment benefits.

Do i have to claim unemployment on my taxes. To pay less tax when you file your return you should request withholding from your unemployment checks. The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. Unemployment benefits are generally treated as income for tax purposes.

While unemployment compensation was retroactively made tax-free on the federal level your state may not conform to the federal rules. You can claim your unemployment-benefits tax waiver in your 2020 income tax return. You can ask to have taxes withheld from your payments when you apply for benefits or you can file IRS Form W-4V Voluntary Withholding with your state unemployment.

Others never do and still others have different rules entirely. Be sure to check your states official website for more information. Important tax planning notes.

Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return. If you received unemployment benefits in 2020 and youve already filed your tax returns the Internal Revenue Service is saying you dont have to file an amended return to claim the new tax waiver. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

Amounts over 10200 for each individual are still taxable. The amounts you receive should be reflected on your taxes on Form 1040 technically you will report not file unemployment on your taxes. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring.

Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free. Federal income tax is withheld from unemployment benefits at a flat rate of 10. Normally all unemployment income is taxable at the federal level but the new relief bill exempts jobless workers first 10200 in benefits for those earning less than 150000.

This tax break will be welcome. If you received more than 10200 in unemployment benefits that will be taxed. To do so youll need the information in your Form 1099-G which shows how much you received in unemployment.

If your modified AGI is 150000 or more you cant exclude any unemployment compensation. You can use Form W-4V Voluntary Withholding Request to have taxes withheld from your benefits. BUT the first 10200 of unemployment benefits you received is not taxable by the IRS.

The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the. The new tax break is an exclusion workers exclude up to 10200. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200.

For example if you received 10500 in unemployment benefits in 2020 that is 300 more than the 10200 tax-free limit. Taxes arent withheld automatically from unemployment benefits. 8 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay.

If you are unemployed in 2021 and receiving unemployment compensation you. Unemployment benefits are like wages and you must report it as income on your tax return if you earned enough income to need to file taxes. Youll need to claim that 300 as income and pay taxes on it.

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or 10200 for all other.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

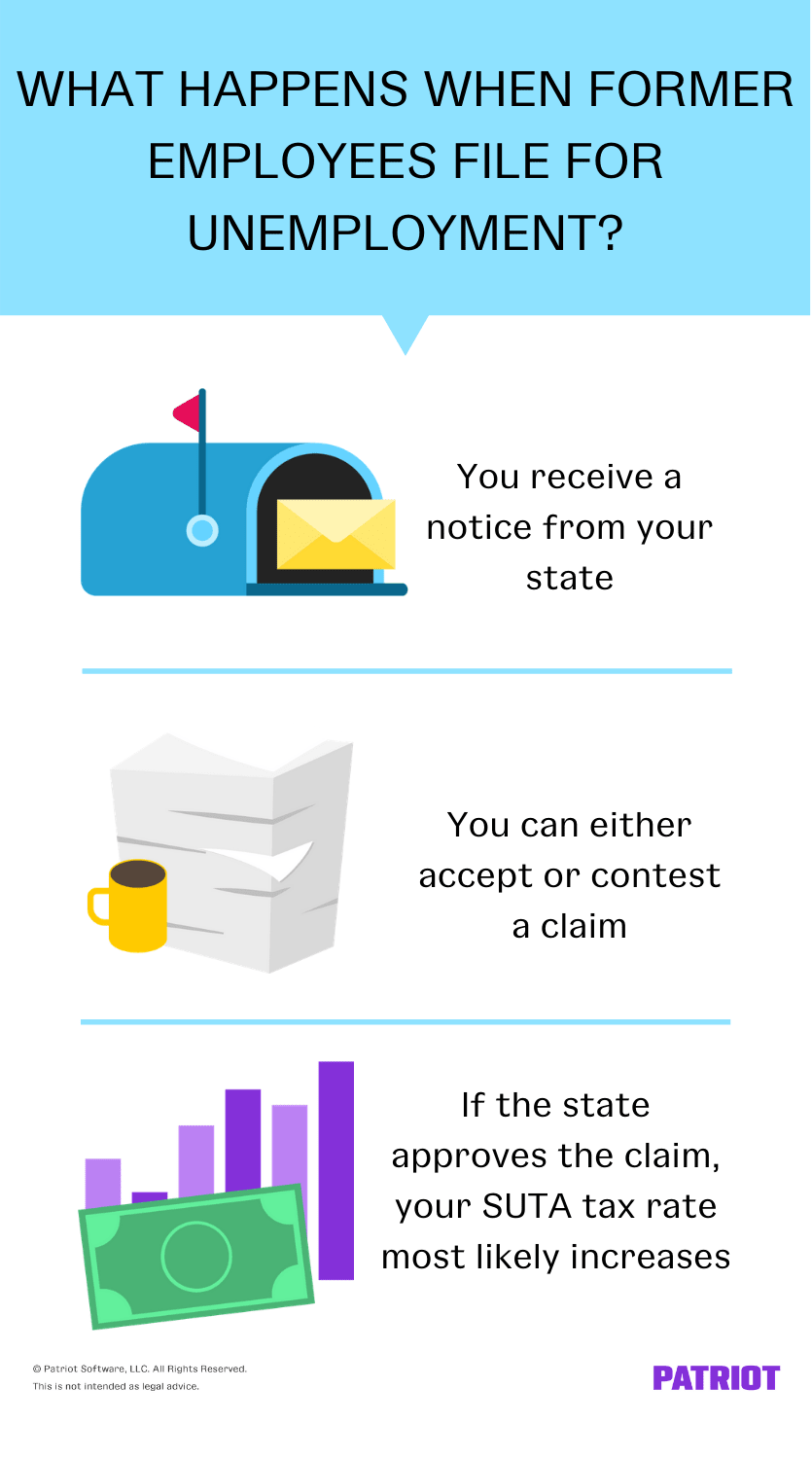

How Does Unemployment Work For Employers Handling Claims

How Does Unemployment Work For Employers Handling Claims

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

/GettyImages-182396779-56a0a54a3df78cafdaa38ff0.jpg) Important Unemployment Tax Questions For Employers

Important Unemployment Tax Questions For Employers

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Taxes Q A How Do I File If I Only Received Unemployment

Taxes Q A How Do I File If I Only Received Unemployment

How To Claim Your Unemployment Tax Break On 2020 Benefits

How To Claim Your Unemployment Tax Break On 2020 Benefits

How Unemployment Stimulus Payments Will Affect Your Taxes Whas11 Com

How Unemployment Stimulus Payments Will Affect Your Taxes Whas11 Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.