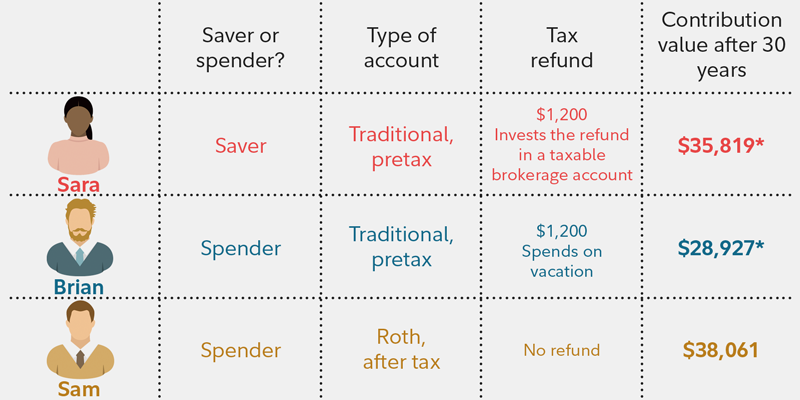

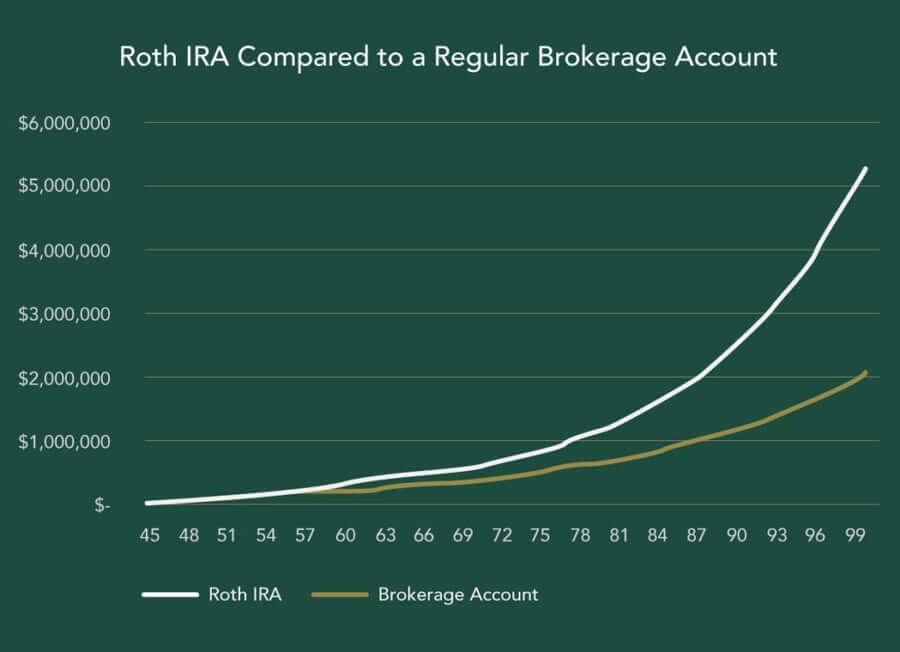

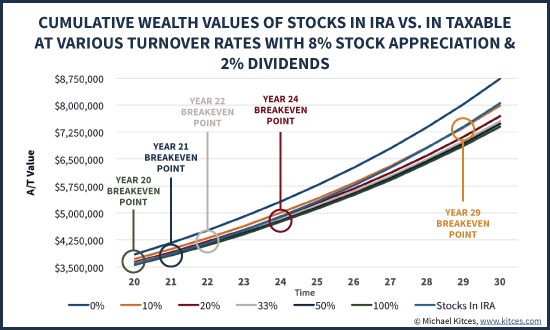

However if you hold your investment securities for longer than a year in your account you can pay the lower long-term capital gains rate of 15 percent. Roth IRA contributions are made on an after-tax basis.

How Does Retirement Work How To Maximize Benefits

How Does Retirement Work How To Maximize Benefits

Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors.

Roth ira or brokerage account. More The Complete Guide to the Roth IRA. An IRA lets you invest in stocks and save for retirement while enjoying certain tax benefits right from within an online brokerage account. An alternative to a Roth IRA account is a brokerage account.

A Roth IRA is an Individual Retirement Arrangement that is funded with post-tax money. For a Roth IRA investors can only contribute the full amount if their modified adjusted gross income is less. Because the Roth IRA is a different kind of account from a regular brokerage account you can get separate insurance protection from the Securities Insurance Protection Corporation.

An Individual Retirement Account IRA is a type of retirement account for US. The major difference between a Roth IRA account and brokerage accounts is that a brokerage account does not offer tax benefits. This article is part of The Motley.

Roth IRAs and traditional IRAs are very similar but they differ in how they are taxed. There is no income limit for a traditional IRA although there is a contribution limit. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors.

300 Assets to Invest Wide Range of Lucrative Assets. But if you want to combine both self. A brokerage account is taxable.

There are plenty of IRA companies that will open the account for you including many banks credit. In other words your dividends or interests that accrue in your brokerage account. Growth in your Roth account is not subject to tax.

A brokerage account is a type of taxable investment account. If you prefer a managed option Betterment or Personal Capital offer a better option. An individual retirement account or IRA is a retirement account you can open for yourself.

For instance you can withdraw cash from your brokerage account with no tax implications or penalties. Different tax rules apply to a brokerage account compared to an IRA. As you can see different investment brokers can accommodate different investor preferences.

Any of the big brokerages including Fidelity Schwab and Vanguard allow customers to set up a Roth IRA account and a taxable account at the same time John Crumrine. With a traditional IRA contributions will be taxed upon the withdrawal of funds from the account. Some Social Security beneficiaries are still waiting for their.

300 Assets to Invest Wide Range of Lucrative Assets. An IRA transfer is the transfer of funds from an individual retirement account IRA to another retirement account brokerage account or bank account. The three most common retirement account types are traditional IRAs Roth IRAs and SEP IRAs.

Best Roth IRA Brokerage Accounts. One of these rulings allows you to pay trustee fees annual investment management fees also called wrap fees but not brokerage commissions from non-IRA funds without them being considered an additional contribution to the IRA accountBecause Roth IRA assets are not touched the ability of the account to earn tax-free income is not. If you prefer self-directed trading you may want to consider Webull or Firstrade.

An IRA or Individual Retirement Account is a retirement-based account that helps you take advantage of the tax incentives that come with them. The tax benefits of a Roth IRA can be very valuable but the flexibility of a regular brokerage account can make having both a smart option for many investors. That is youre investing in the account with money that has already been taxed or youre paying tax on the money when you convert it from tax-deferred to Roth.

These accounts have no tax benefits but they offer fewer restrictions and more flexibility than does a tax-advantaged account such as a Roth IRA.

Brokerage Account Vs Ira What S The Right Move The Ascent

Brokerage Account Vs Ira What S The Right Move The Ascent

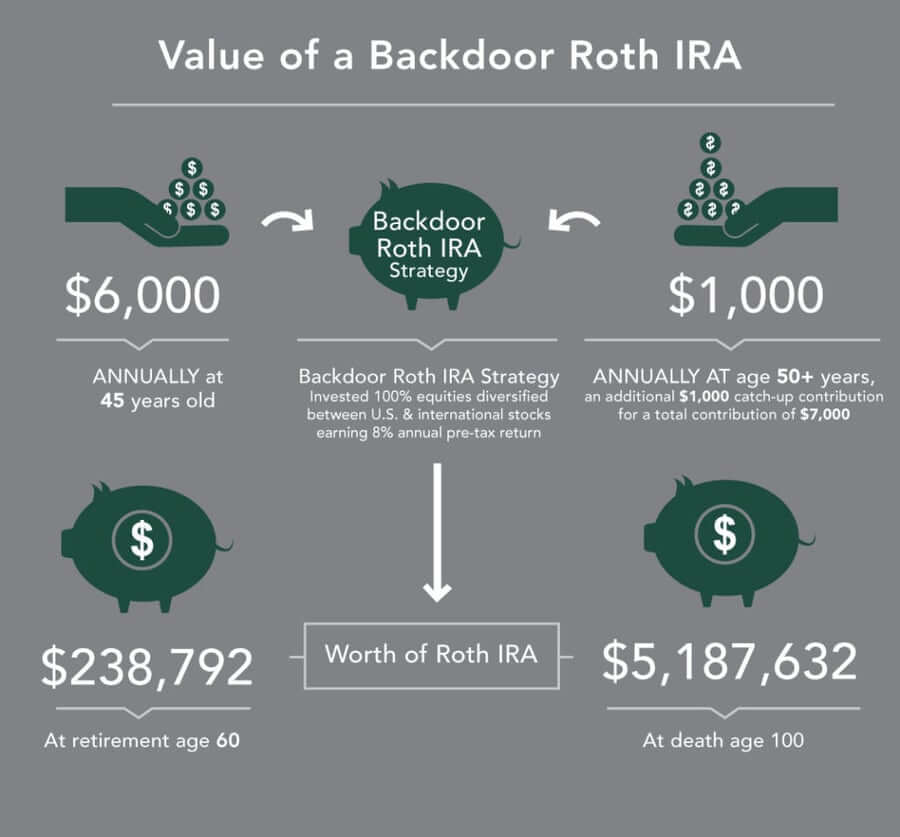

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

How Brokerage Accounts Are Taxed In 2021 A Guide

How Brokerage Accounts Are Taxed In 2021 A Guide

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

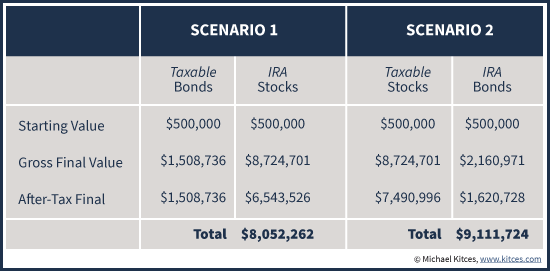

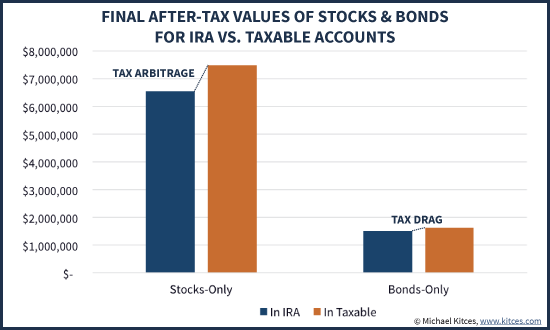

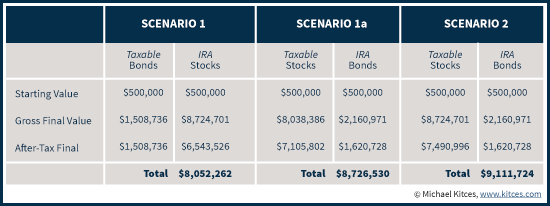

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Where Can I Invest After Maxing Out My Roth Ira Personal Finance Club

Where Can I Invest After Maxing Out My Roth Ira Personal Finance Club

How And Where To Open An Ira Nerdwallet

How And Where To Open An Ira Nerdwallet

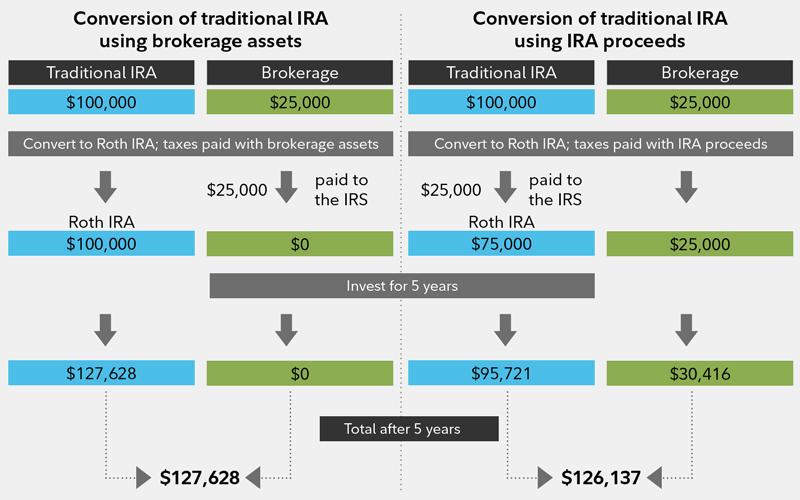

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

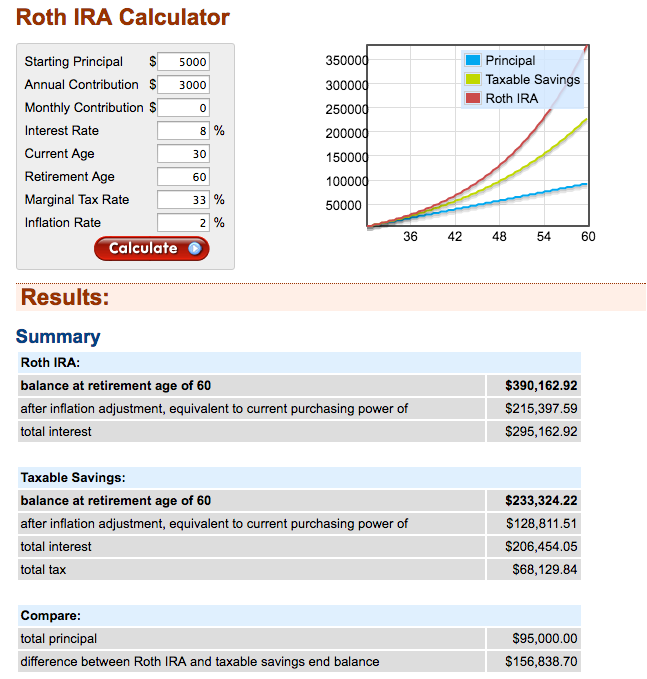

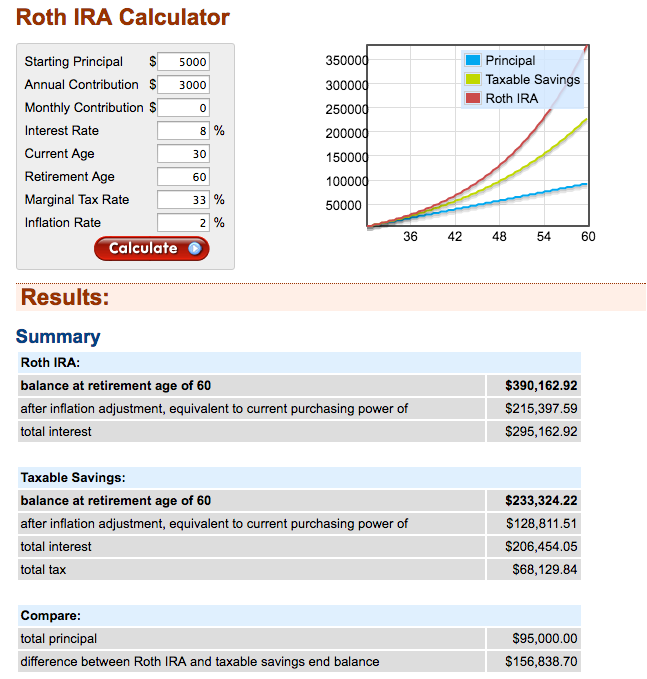

Best Stocks With Potential Roth Ira Vs Brokerage Account Calculator Discovery Optometry

Best Stocks With Potential Roth Ira Vs Brokerage Account Calculator Discovery Optometry

Investing Beyond Your 401 K How To Do It And Why You Should

Investing Beyond Your 401 K How To Do It And Why You Should

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.