Essentially the way that Medicaid works is that your parent would have to spend down their savings and liquidate their assets to pay for their nursing home care. At the time that these benefits reach the accepted limit your parent would then qualify for Medicaid which would then cover the costs of long-term care in a nursing home.

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

Ad COTS application for AIS Radar and Camera display.

Protecting assets from nursing home costs. The Federal Spousal Impoverishment Act protects the spouses of nursing home patients by permitting them to exclude their own income when paying for a spouses nursing home care. When created for the purpose of protecting assets from being used for nursing home or other long-term care costs the term Medicaid trust may be used to describe this type of irrevocable trust. We can discuss the best method to protect your assets while planning for your health care needs.

Send this article to somone who wants to protect their home from nursing home expenses. Compare this with a revocable or living trust which offers no asset protection for Medicaid purposes because the government considers the assets in a revocable trust to still be your property. Set up a trust.

So here since the house is only worth 500000 the Medicaid applicant will not. Will Medicare pay for my nursing home costs. It is illegal to hide money from the government but a living trust helps you shelter.

Nursing home was 7513. If your spouses income is less than the amount your state exempts you can direct a portion of your income to your spouse to bridge the gap. In many cases the reduction can amount to thousands of dollars every year.

If a trust is created for the purpose of protecting assets from being used for long-term care costs it is referred to as a Medicaid trust A Medicaid Asset Protection Trust MAPT enables a person who would otherwise be ineligible for Medicaid to become eligible to receive nursing home care. In the case of nursing home costs you want to set up a living trust. Coastal area monitoring with automated alarms.

In Florida houses valued at 560000 as of January 2017 can be exempt from being counted as a resource in the eyes of Medicaid if the applicant has an intent to return home. A key component to proper planning is setting up a trust. Under Medicaid spousal impoverishment rules Marian is allowed to keep 25000 as her protected allowance and John is permitted to retain 2000.

Nursing home costs average 70000 a year with an average cost per stay of 170000. Call 781-996-5656 or toll free at 800-701-0352. According to the annual Genworth Cost of Care Survey in 2019 the median monthly cost of a semi-private room in a US.

Medicare does not the pay the expenses of long-term care incurred for day care at adult centers home care by relatives or employed caretakers and nursing home care. Even if you wouldnt normally fall into the low-income category there are ways to shelter your assets and increase your chances of eligibility for nursing home care coverage. The Means Tested Fee is the fee that can potentially be drastically reduced through the restructure of income and assets and by protecting assets from nursing home assessment through various aged care financial planning strategies.

Ad COTS application for AIS Radar and Camera display. The best way to protect money from nursing home costs is to make a Medicaid plan. The cap does not cover board and lodging costs which will have to be paid on an annual basis probably around 12500 pa.

Propose to cap care home fees at 72000 per person but this is based on the notional amount a local authority will pay. John and Marian Jones have a home and 10000000 of countable savings when John enters a nursing home for a long-term stay. Coastal area monitoring with automated alarms.

John and Marian Jones have a home and 50000 of savings when John enters a nursing home for a long term stay. This involves structuring the ownership of your wealth so it does not count as financial resources for purposes of qualifying for means-tested Medicaid coverage. Under Medicaid spousal impoverishment rules Marian is allowed to keep 5000000 as her protected allowance and John is permitted to retain 240000.

Protecting Assets From Nursing Home Costs In Pennsylvania Retirement Planning Financial Advisor

Protecting Assets From Nursing Home Costs In Pennsylvania Retirement Planning Financial Advisor

Family Money Protection Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Family Money Protection Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Your Guide To Protecting Assets From Nursing Home Costs

Your Guide To Protecting Assets From Nursing Home Costs

How To Protect Your Assets From Nursing Home Costs Legalzoom Com

How To Protect Your Assets From Nursing Home Costs Legalzoom Com

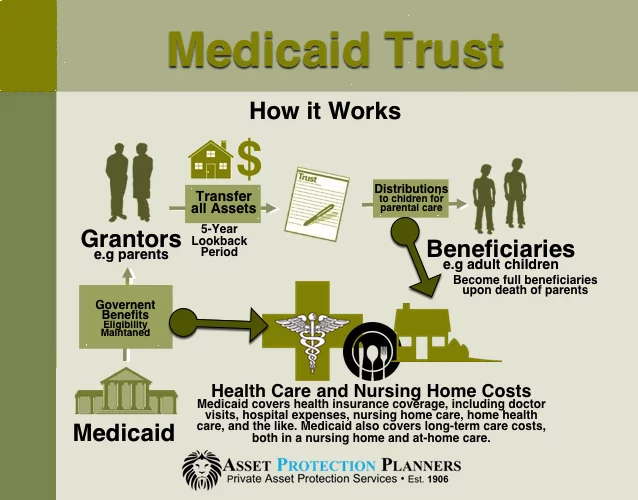

Medicaid Trust For Asset Protection From Nursing Home Costs

Medicaid Trust For Asset Protection From Nursing Home Costs

Protecting Your Assets From Nursing Home Costs

Protecting Your Assets From Nursing Home Costs

How To Protect Assets From Nursing Home Expenses 13 Steps

How To Protect Assets From Nursing Home Expenses 13 Steps

Estate Planning Watertown Protect Your Assets From Nursing Homes

Estate Planning Watertown Protect Your Assets From Nursing Homes

Protecting Your Assets From Nursing Home Costs Legacy Lawyers

Protecting Your Assets From Nursing Home Costs Legacy Lawyers

Pdf Read Online How To Protect Your Family S Assets From Devastatin

Pdf Read Online How To Protect Your Family S Assets From Devastatin

How To Protect Your Assets From The Costs Of Nursing Home Care

How To Protect Your Assets From The Costs Of Nursing Home Care

How To Protect Your Family S Assets From Devastating Nursing Home Costs Medicaid Secrets 15th Ed Heiser K Gabriel 9045650152243 Amazon Com Books

How To Protect Your Family S Assets From Devastating Nursing Home Costs Medicaid Secrets 15th Ed Heiser K Gabriel 9045650152243 Amazon Com Books

Full Book How To Protect Your Family S Assets From Devastating Nursi

Full Book How To Protect Your Family S Assets From Devastating Nursi

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.